How to create Robot Trading strategies with AlgoGen

Follow along to create a trading robot from scratch in just a few minutes.

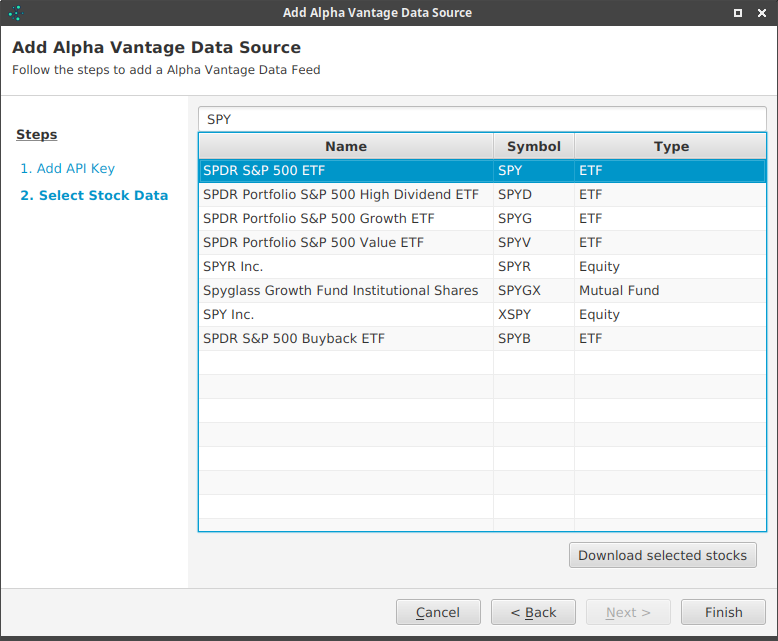

Download Data

When you set out to create a new trading robot in AlgoGen, you need to start with your choice of data.

AlgoGen allows you to import your own data in CSV format or to download data from AlphaVantage.

Once you have decided what market you want to build a robot for, you can move on to selecting your signals.

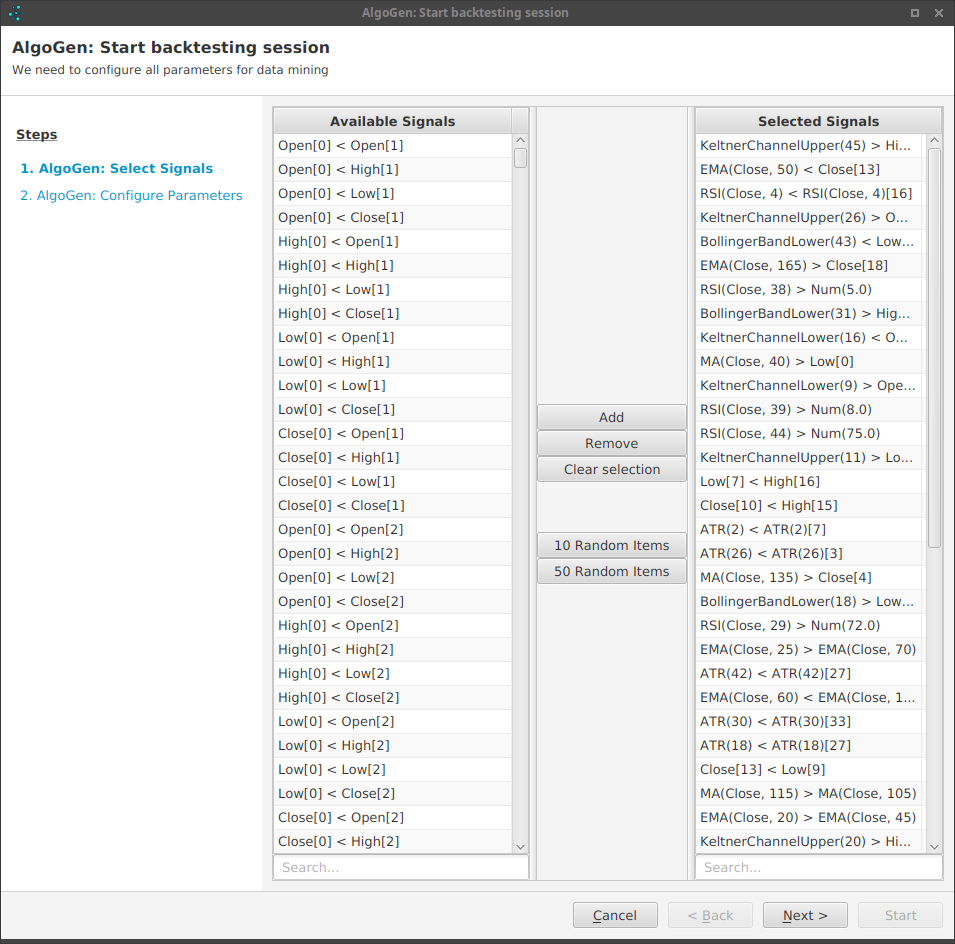

Select Your Signals

AlgoGen offers thousands of signals on which to base your trading robot.

You can either select specific signals that you're interested in trading or let AlgoGen choose signals for you.

AlgoGen will then use all your selected signals and combine them to form thousands of potential trading strategies.

These strategies are then passed to the next step: Backtesting!

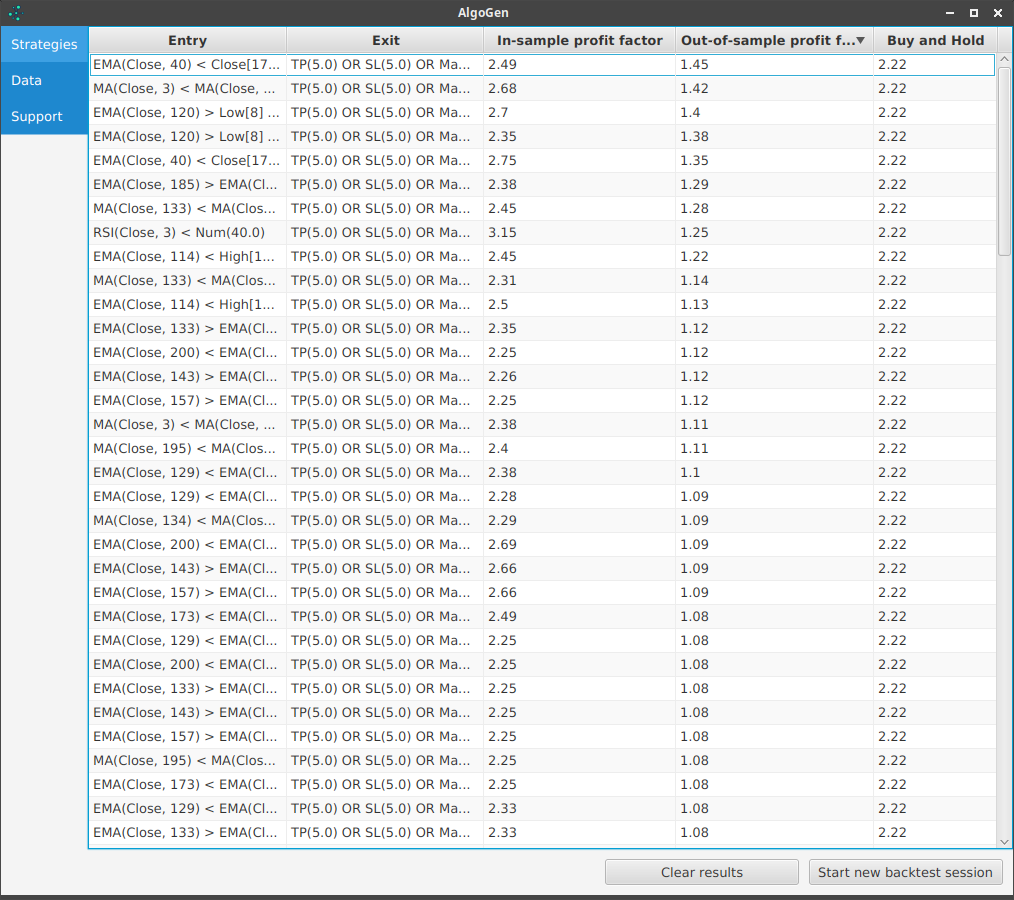

Backtest your signals

AlgoGen usually creates tens of thousands of potential trading strategies from only a few dozen selected signals and then starts automatically exploring all of them. AlgoGen checks every strategy for profitability and weather it outperforms the underlying market.

Every strategy that outperforms the underlying market is added to your results.

Inspect your results

AlgoGen usually finishes backtesting your strategies within a few minutes and once it's done you can inspect your generated robot trading strategies.

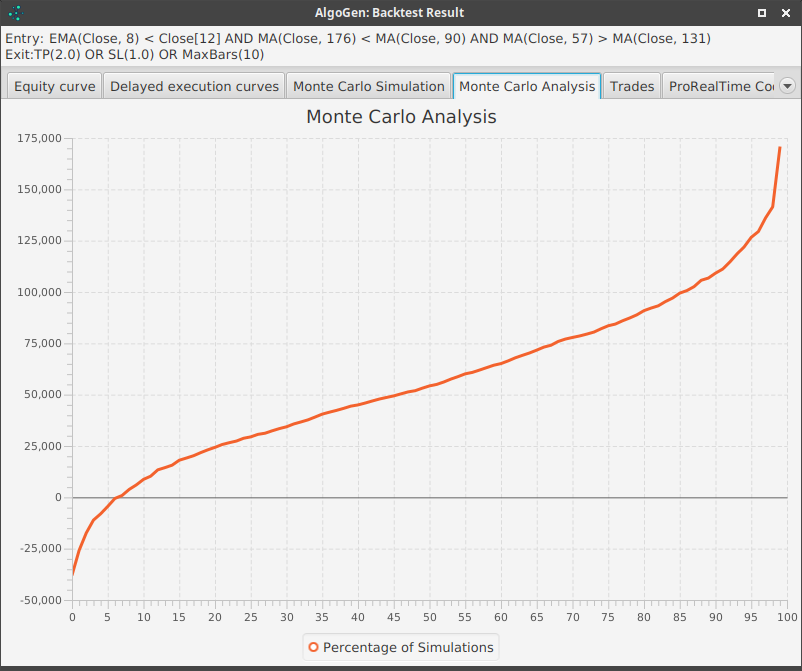

Make your decision on what robot trading strategies you want to carry forward based on:

Equity Curve

Delayed Execution Curves

Monte Carlo Simulations

Monte Carlo Analysis

Trade statistics

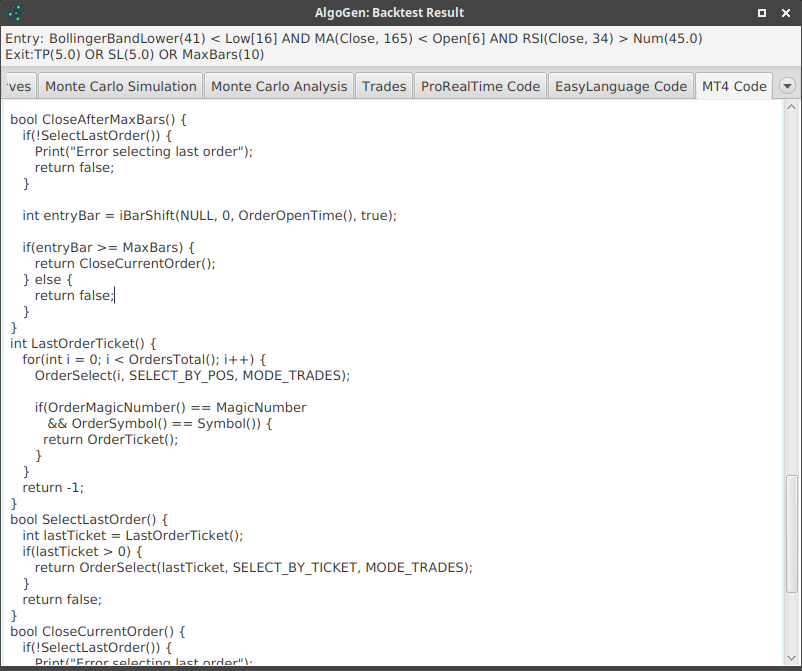

Export Robot Code

Once you are satisfied with your selection of robot trading strategies, you can export them to the trading platform you currently use.

AlgoGen can export robot trading strategies to MultiCharts, TradeStation, ProRealTime and others.

Join the AlgoGen community

Risk Disclosure:

Trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones' financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

© AlgoGen 2021 All rights reserved.