Crypto bear markets and leverage

Looking at the returns of leveraged crypto positions in a bear market

Bitcoin Bear Market

Almost exactly three months ago I wrote a post looking at the outcomes of investing in the top 10 cryptos during a bull market. In that post I picked 2017-12-01 as the start date of the study, the middle of the 2017/2018 bull market in crypto.

The crypto market has now been retreating from its heights for a couple of months now and in this post I will look at the effects of investing in crypto during a bear market.

I picked the start date of this study to be 2018-02-01 - the middle of the retracement of the 2017/2018 crypto bull market. As in the previous post, I used the list of top 10 crypto currencies as available on CoinMarketCap reflecting 2018-02-01.

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Bitcoin Cash (BCH)

- Cardano (ADA)

- Stellar (XLM)

- Neo (NEO)

- Litecoin (LTC)

- Eos (EOS)

- NEM (XEM)

All the following studies examine buying and holding crypto with 1:1, 1:2 and 1:5 leverage.

Bitcoin

Ethereum

Ripple

Bitcoin Cash

Cardano

Stellar

Neo

Litecoin

Eos

NEM

Results

| Pair | Leverage | Return | Maximum Drawdown | Longest drawdown period (days) |

|---|---|---|---|---|

| BTC-USD | 1:1.0 | 367% | -72% | 482 |

| BTC-USD | 1:2.0 | 149% | -95% | 1025 |

| BTC-USD | 1:5.0 | 0% | -101% | 1232 |

| - | ||||

| ETH-USD | 1:1.0 | 199% | -92% | 1064 |

| ETH-USD | 1:2.0 | 7% | -100% | 1232 |

| ETH-USD | 1:5.0 | 0% | -100% | 1232 |

| - | ||||

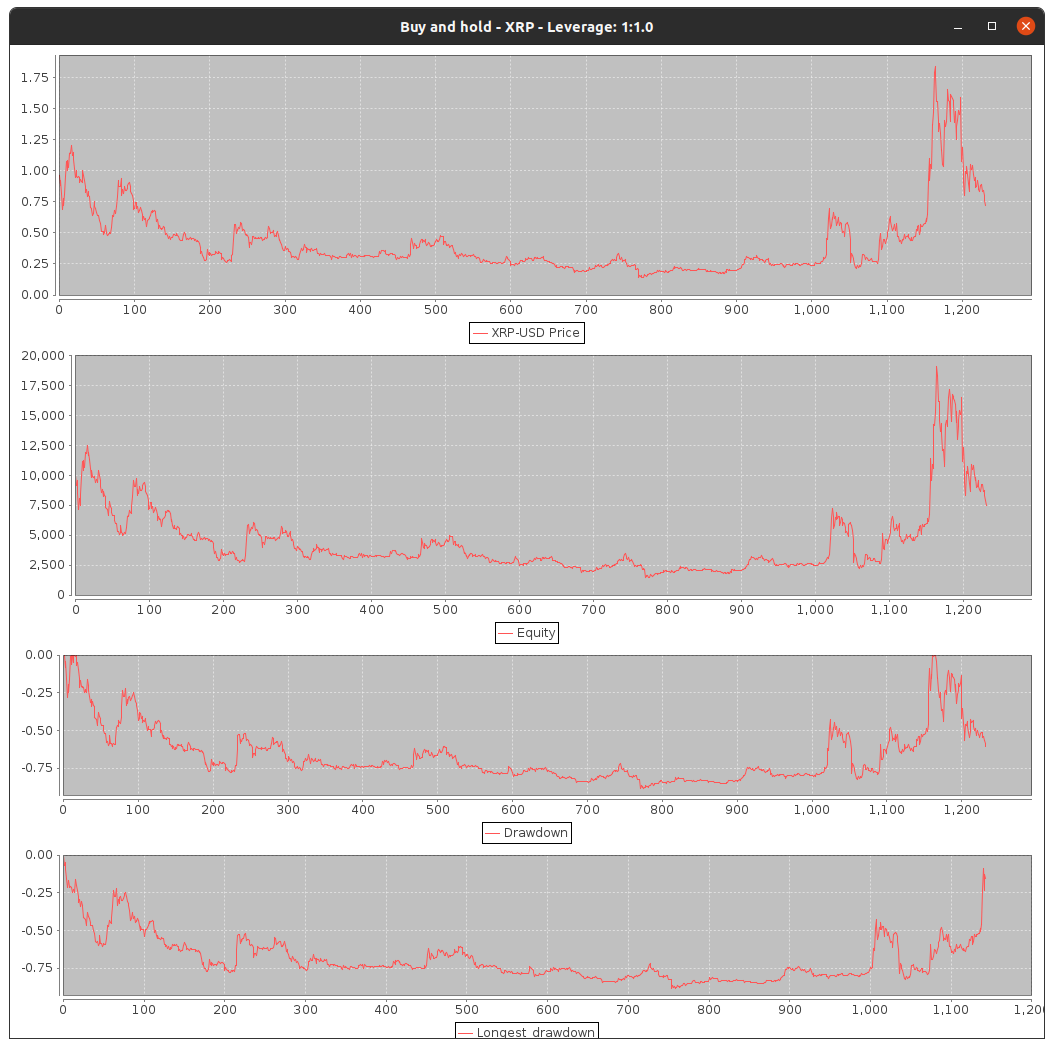

| XRP-USD | 1:1.0 | 73% | -88% | 1144 |

| XRP-USD | 1:2.0 | 0% | -100% | 1216 |

| XRP-USD | 1:5.0 | 0% | -100% | 1232 |

| - | ||||

| BCH-USD | 1:1.0 | 41% | -96% | 1138 |

| BCH-USD | 1:2.0 | 0% | -100% | 1217 |

| BCH-USD | 1:5.0 | 0% | -173% | 1232 |

| - | ||||

| ADA-USD | 1:1.0 | 313% | -95% | 1092 |

| ADA-USD | 1:2.0 | 8% | -100% | 1230 |

| ADA-USD | 1:5.0 | 0% | -100% | 1230 |

| - | ||||

| XLM-USD | 1:1.0 | 60% | -93% | 1087 |

| XLM-USD | 1:2.0 | 0% | -100% | 1232 |

| XLM-USD | 1:5.0 | 0% | -100% | 1232 |

| - | ||||

| NEO-USD | 1:1.0 | 33% | -96% | 1206 |

| NEO-USD | 1:2.0 | 0% | -100% | 1232 |

| NEO-USD | 1:5.0 | 0% | -131% | 1232 |

| - | ||||

| LTC-USD | 1:1.0 | 102% | -90% | 1089 |

| LTC-USD | 1:2.0 | 2% | -100% | 1213 |

| LTC-USD | 1:5.0 | 0% | -100% | 1217 |

| - | ||||

| EOS-USD | 1:1.0 | 41% | -92% | 1145 |

| EOS-USD | 1:2.0 | 0% | -100% | 1145 |

| EOS-USD | 1:5.0 | 0% | -100% | 1232 |

| - | ||||

| XEM-USD | 1:1.0 | 22% | -95% | 1111 |

| XEM-USD | 1:2.0 | 0% | -100% | 1230 |

| XEM-USD | 1:5.0 | 0% | -100% | 1232 |

Conclusion

Unsurprisingly, investing in a leveraged crypto portfolio during a downturn leads to extreme losses. With the exception of Bitcoin, all cryptos would have lost the whole stake.

Using no leverage, the picture looks slightly better. An equal weighted portfolio of all top 10 coins would have returned 25% with drawdowns of over 90%. In the scheme of things, that represents a terrible risk adjusted return.

Interested in more? Check out:

Crypto bull runs and leverage

We look at the effect of investing in the top 10 cryptos during a bull run.

The Effects of holding ETFs with leverage

Trading with leverage can be risky because gains and losses are magnified. This post explores the magnitude in change of gains and losses.

The effects of dodging the worst days

We know that avoiding the best trading days has a huge negative impact on our returns, but what happens if we could avoid the worst trading days?

MetaTrader 4 Keltner Channel

The source code for a custom MT 4 Keltner Channel indicator

Join the AlgoGen community

Risk Disclosure:

Trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones' financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

© AlgoGen 2021 All rights reserved.