Create hundreds of Algorithmic Trading Strategies instantly.

AlgoGen is is the easiest way to create and research Algorithmic Trading strategies without writing a single line of code.

Built for everyone

AlgoGen is as simple as possible without compromising on what matters when doing Algorithmic Trading Research.

How AlgoGen works

Experience advanced automated strategy generation and backtesting.

No Coding

AlgoGen is designed to allow anyone to do Algo Trading Research without any programming

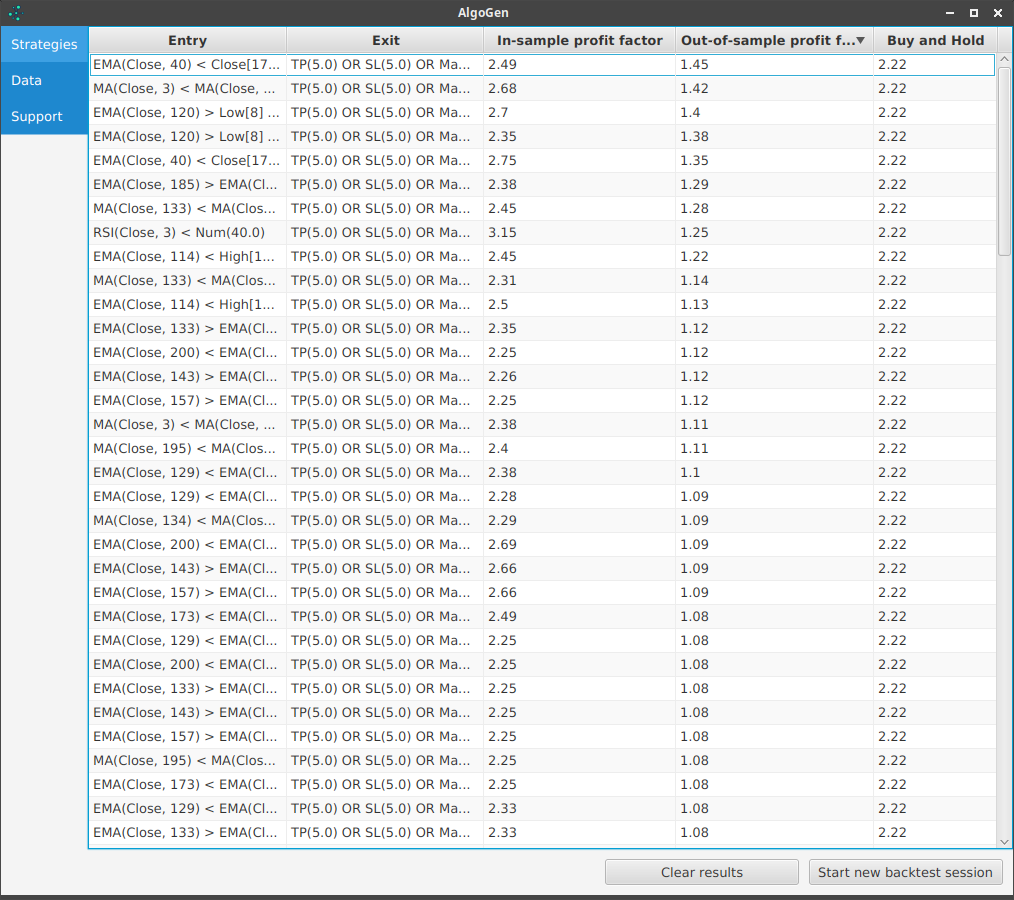

Automated algo search

Scan through thousands of generated strategies. Select your favourite features and let AlgoGen do the work.

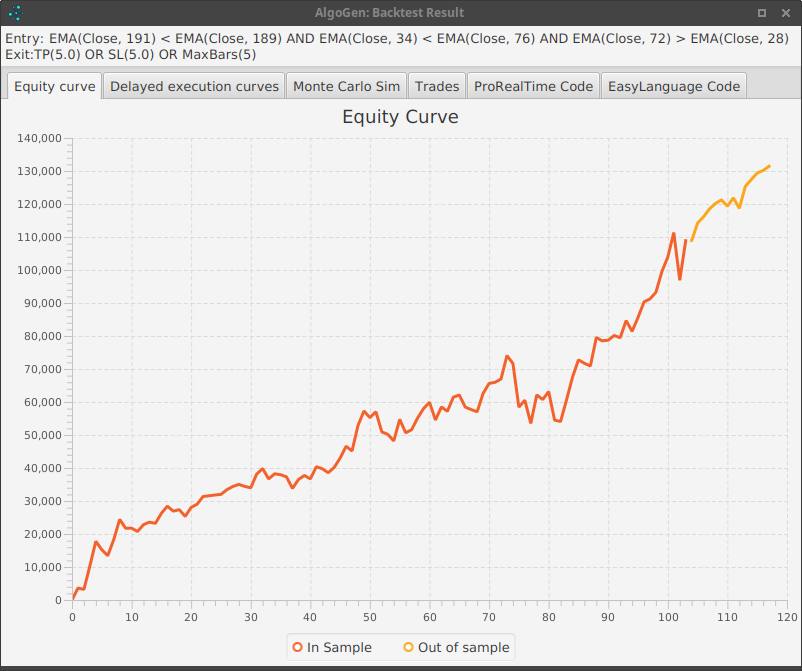

In-sample and out-of-sample

Run automated out-of-sample tests on every winning algorithm.

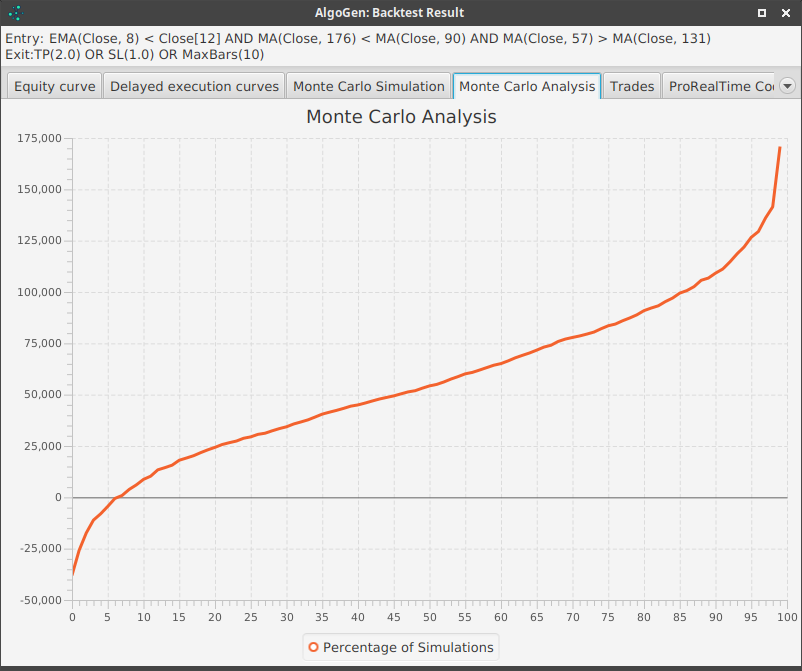

Robustness testing

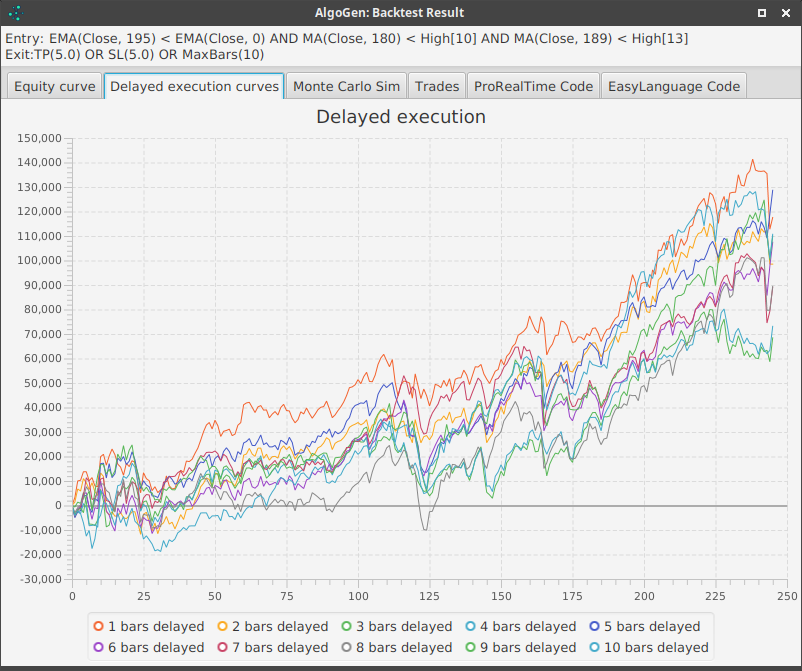

Test winning algorithms for robustness with delayed execution and Monte Carlo simulations.

Keep track

Keep track of how your algorithms are doing over time individually and as a portfolio.

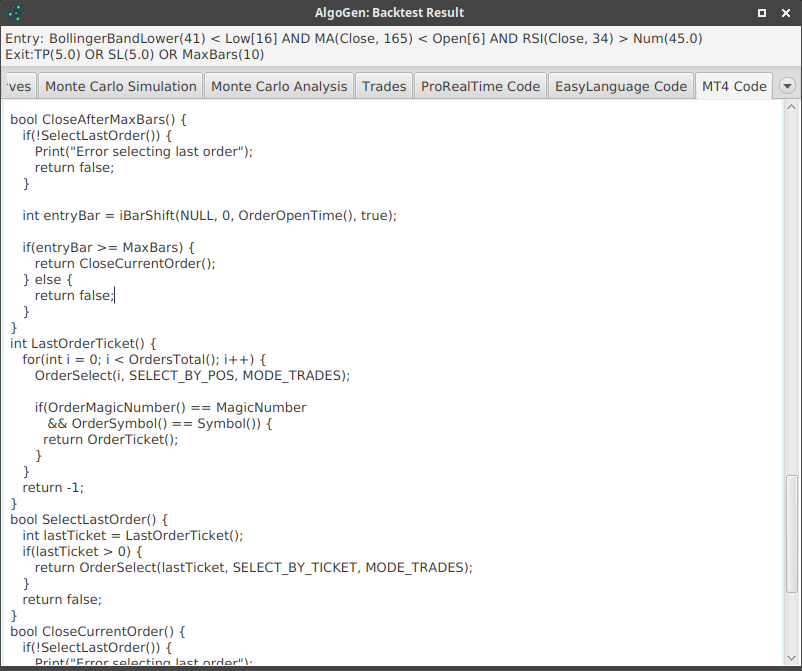

Generate code

Export winning algorithms to ProRealtime, EasyLanguage, MT4 and MT5, Ninja Trader and Trading View.

Run your algorithms

Run winning algorithms in your preferred trading software.

Let's keep in touch

Sign up to our newsletter and we'll send you some of our generated strategies to check out.

Exclusive access for committed clients

AlgoGen is an Algorithmic Trading Research platform for people who are serious about their algorithms. Please get in touch for pricing.

Currently we support TradeStation, MultiCharts, ProRealTime and MT4

We will be adding support for NinjaTrader and TradingView.

We are currently importing stock and forex data from Yahoo Finance.

Yes, AlgoGen offers an option to import your own CSV data.

We support credit cards via Stripe and PayPal.

Yes, we do. Please check out the feature section of the website.

Join the AlgoGen community

Risk Disclosure:

Trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones' financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

© AlgoGen 2021 All rights reserved.